THE EDGE. 3RD OCTOBER: The Penang property market has seen limited transactions for two consecutive quarters, resulting in steady transacted prices and a lack of significant quarter-on-quarter (q-o-q) price movement, according to Nawawi Tie Leung Property Consultants Sdn Bhd executive director and regional head of research and consulting Saleha Yusof when presenting The Edge Malaysia | Nawawi Tie Leung Property Consultants Penang Housing Property Monitor (2Q2023). She says most schemes showed a flat performance in the quarter under review.

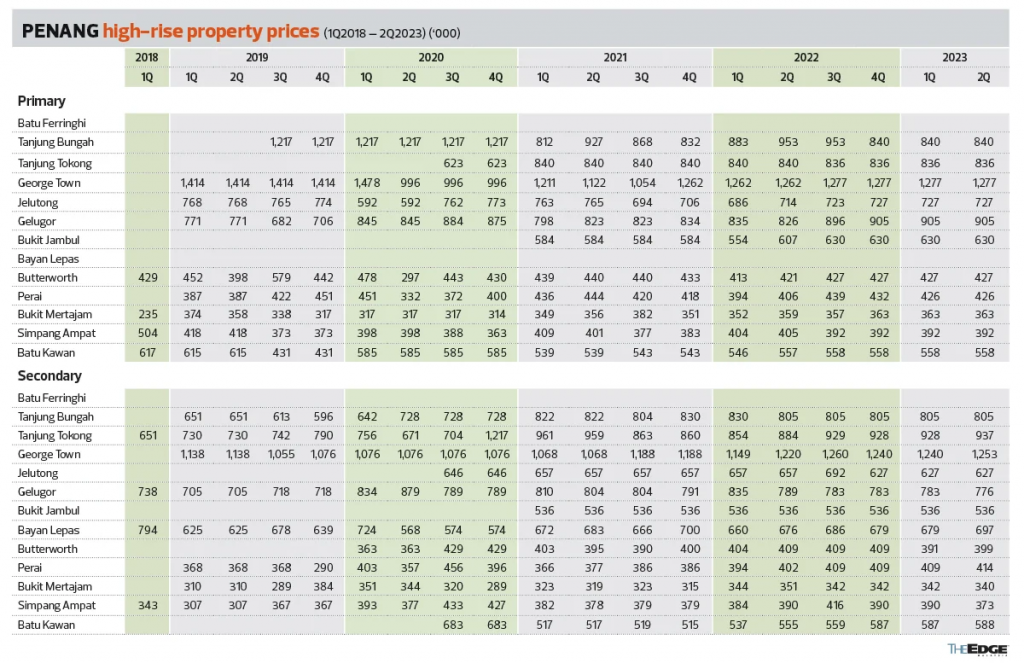

“For high-rise, all transactions recorded in the second quarter were in the secondary market, with about 85% recorded on the mainland, mostly in Batu Kawan,” she says.

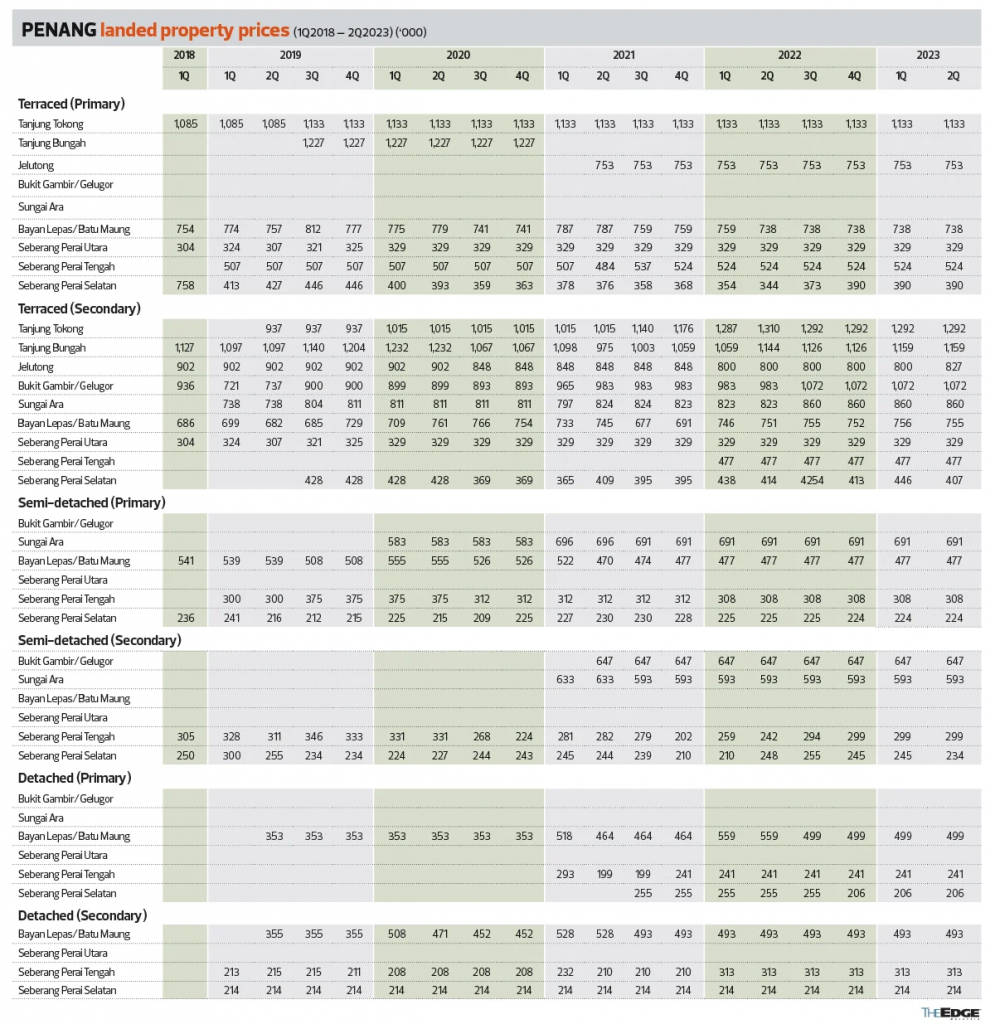

“For landed homes, all transactions recorded were also in the secondary market, with about 76% recorded on the mainland. [They were] all in Seberang Perai Selatan, mostly terraced and semi-detached houses. As the supply of semi-detached houses is limited on the secondary market, we noted significant year-on-year (y-o-y) increases in transacted prices, such as 10% at Hijauan Valdor. Well-

positioned townships, such as Eco Horizon, recorded a 22% increase in prices y-o-y for terraced houses.”

She adds that developers are more cautious now due to rising costs and they are targeting “real home buyers”. As a result, new launches have slowed compared with the pre-Covid era.

“[It is important for] developers to strengthen the appeal of their products with unique selling propositions that are relevant and add value to the life and well-being of buyers. The fewer launches have several impacts on the property market, including [a lower number] of overhang units, as units launched are targeted for specific market segments; higher take-up rates of existing projects; and price correction in the high-rise residential properties to match the affordability level of ‘real home buyers’. Also, the higher construction cost could affect the supply of affordable housing.”

Remaining active

Saleha observes that the market remained active in the quarter under review with developers focusing on the affordable and mid-range segments priced between RM300,000 and RM700,000.

She adds that the secondary market was active too, especially in strategic locations such as Batu Kawan, Bayan Lepas and Seberang Perai Selatan.

Penang is known for its industrial activities. In 2Q2023, it attracted investments in the manufacturing sector — about 70% was contributed by foreign direct investment and 30% by domestic direct investment. Several new investments announced in the same quarter are expected to have positive impacts on the state’s economy and real estate market.

These investments include:

• German medical and pharmaceutical device company B. Braun Medical Industries Sdn Bhd’s plan to enlarge its production lines, introduce new portfolios and expand its centre of excellence with more investments in research and development (R&D) capabilities. The investment targeted for 2023 is about RM100 million to RM200 million.

• Japan-based vacuum and planarisation technologies company Ebara Precision Machinery Malaysia Sdn Bhd’s plan to set up its first manufacturing facility in the Batu Kawan Industrial Park. This is to tap into the growing demand for various precision needs from the semiconductor, light-emitting diode and electronic industries in Penang. The RM30.4 million facility is expected to create up to 60 jobs.

• US-based semiconductor manufacturing company GlobalFoundries’ plan to open a new centre of excellence that will be a hub to oversee its global operations in Singapore, Germany and New York.

• Malaysian-based Industrialised Building System (IBS) modular home manufacturer Slimhaus Technology Sdn Bhd’s announcement of the setting up of its first manufacturing facility at Valdor, Seberang Perai, with an investment of RM18 million. Operational in July this year with 20 job openings, the 35,000 sq ft manufacturing facility manufactures IBS steel frames, modular and steel frame packages. The company also plans to set up a second plant by 2025 for R&D purposes.

Saleha notes that the continuous flow of investment, especially in the electrical and electronics (E&E) and medical devices sectors, has resulted in the expansion of industrial developments in Penang by various developers. Therefore, demand for industrial properties remains strong in Penang, mainly from the E&E and medical devices sectors.

Some of the industrial developments are Bandar Cassia Technology Park and Penang Technology Park @ Bertam. Located in Bandar Cassia, the 246-acre Bandar Cassia Technology Park — to be developed in five phases by Penang Development Corporation (PDC) — will be completed in August 2025.

The 880-acre Penang Technology Park @ Bertam, meanwhile, offers built-to-lease and built-to-suit lease options of detached and semi-detached factories of various sizes. To be infrastructure-ready by 4Q2024, the industrial park is expected to create 30,000 jobs.

MedTech Hub of Asia

While Penang is known for its industrial hub, it is also set to become the MedTech Hub of Asia due to its rising exports in professional, scientific and controlling instruments and apparatus including medical devices.

According to Draf Rancangan Tempatan Seberang Perai 2030, Bandar Cassia is positioned as one of the six Pusat Separa Wilayah on the mainland, says Saleha. The Science Park and Medical Hub have been identified as catalysts to stimulate economic growth in Seberang Perai Selatan.

“In line with this objective, Fajarbaru Builder Group Bhd signed a memorandum of understanding with PDC on June 28 to develop a medical city on a 230-acre parcel in Bandar Cassia, Batu Kawan, which translates into approximately 30 million sq ft of gross floor area (GFA) on the assumption of a plot ratio of 1:3,” she says.

“Assuming the medical hub is a mixed-use commercial (development), 60% or 18 million sq ft of the GFA will be allocated for commercial uses, such as a medical centre, healthcare and wellness hub, rehabilitation centre, senior living village, offices, hotels and retail spaces.”

Saleha says global MedTech hubs attract companies from sectors such as pharmaceutical and biotechnology, life science, biopharmaceutical manufacturing, biotechnology and vaccine, medical devices as well as biomedical, therefore, there will be growing demand for industrial properties and supporting uses, such as R&D labs and office spaces in the state.

“Top global MedTech hubs offer lab spaces, ranging from eight million to 26.8 million sq ft. To support manufacturing activities, there will also be demand for CLQ (centralised labour quarters). With the enforcement of the Workers’ Minimum Standards of Housing and Amenities (Amendment) 2019 (Act 1604) in September 2020, there is an opportunity to develop investment-grade CLQs managed by professional teams,” she explains.

“MedTech companies will offer more diversified job opportunities, especially high-skilled workers. In the US, the average salary in the MedTech industry is 11% higher than the national average. In Malaysia, the average salary for a medical technologist is about RM6,700 per month. We expect these workers will create demand for better-quality residential units with prices ranging from RM400,000 to RM650,000.”