THE EDGE. 18TH OCTOBER: Sime Darby Property Bhd (SDP), the country’s largest property developer by land bank, will consider new ventures, including potential opportunities to develop properties abroad, as it looks to advance its third engine of growth.

The group, which is on a journey to transform itself from a pure-play property developer into a real estate player with multiple sources of income by 2025, has identified three growth engines.

The first is its core business of property development, while the second is the recurring-income business — derived from investment and asset management — that it is actively looking to build in order to secure stable, long-term income.

“Our third engine is where we want to allow for a bit of experimentation, or look at new things that we typically do not get into,” group managing director Datuk Azmir Merican tells The Edge in an interview.

He says these could include innovation in affordable homes as well as the possibility of doing property developments outside Malaysia. “For example, affordable housing is a very big thing for us. We have to get the formula right. Once we have that, we will be able to do it well. [Apart from that], we are also looking at how we can look at markets beyond Malaysia.”

Be that as it may, the group has no concrete plans at the moment as there are many factors to consider.

Currently, the only development project it has outside of Malaysia is the Battersea Power Station (Battersea) in the UK. SDP, together with its partners S P Setia Bhd and the Employees Provident Fund (EPF), are shareholders of the project.

Pressed on which external markets the group is eyeing, Azmir says: “Well, we’re in the UK already, so we are looking at that. After investing for 10 years and building that track record, we should be able to do more. We know the market better now. There is also one more market [we’re looking at] that is popular with Malaysian developers.”

Analysts believe the other market is likely to be Australia.

Azmir stresses, however, that SDP is in no rush to pursue any deals abroad. “If we find the right opportunity, we will do it; if we don’t, we won’t.”

He also highlights the fact that there will be separate resources allocated for all three engines that are firing up. “You can’t ask the same people doing property development to do the second and third engines. There is always going to be a trade-off, so we need to allocate the appropriate resources for Engines 2 and 3 separately.”

Azmir points out that SDP already has a significant footprint in Malaysia.

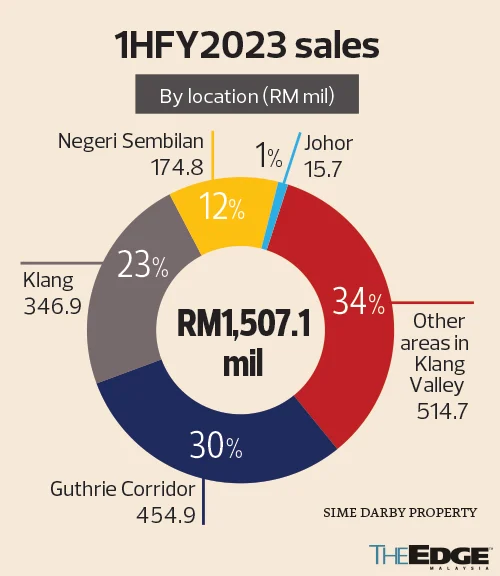

“We are already the largest developer of landed homes in the largest markets, which are the Klang Valley and Negeri Sembilan. We are probably the largest in the industrial segment as well today. So whatever there is in Malaysia, we have already got a significant piece of that market. We have to be able to then go into new things, and those things need to be sizeable and be able to move the needle. That is the impetus [for us to do all this],” he says.

According to Azmir, SDP’s move to transform into a real estate company, which will help it generate recurring income, is progressing well.

He says the group has thus far raised RM700 million for its maiden industrial development fund (IDF), which it established as a 51:49 joint venture with Australia’s Logos Property Group in September 2021. The IDF, which focuses on the logistics sector — it has already started the construction of two industrial hubs in SDP’s Bandar Bukit Raja township in Klang — was a major first step towards broadening recurring income.

“PNB (Permodalan Nasional Bhd) and KWAP (Kumpulan Wang Persaraan Diperbadankan) are our anchor investors, and we have successfully raised about RM700 million, with about RM300 million to go. We expect to close the fund at RM1 billion by the first quarter of 2024,” he says. “Assets under management (AUM) is a critical metric for us. What [we] want to do is to keep launching new funds and products so that [we] are able to grow AUM.”

In its bid to broaden its income base, SDP’s target is to have a 70:30 split between property development income and recurring income.

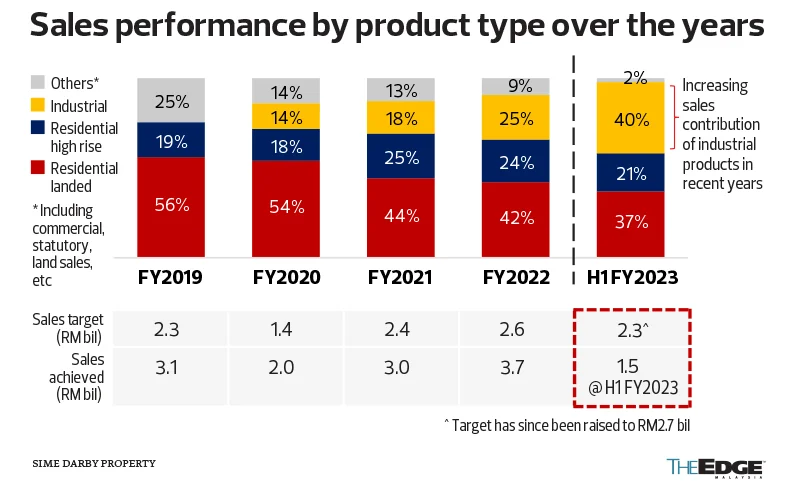

“Currently, we are at 90:10,” says Azmir, pointing out that growth in its bread-and-butter property development business has been strong, with high-rise developments driving the trajectory.

“Traditionally, we have excelled in landed homes. But now, we are also strong in integrated high-rise development. If you see, this year, we are planning to launch more than RM1 billion [worth] of high-rise developments. That is not something we have typically done in the past. We’re looking at [launching] about RM1 billion to RM1.5 billion a year,” he adds.

Battersea drag and cost pressures

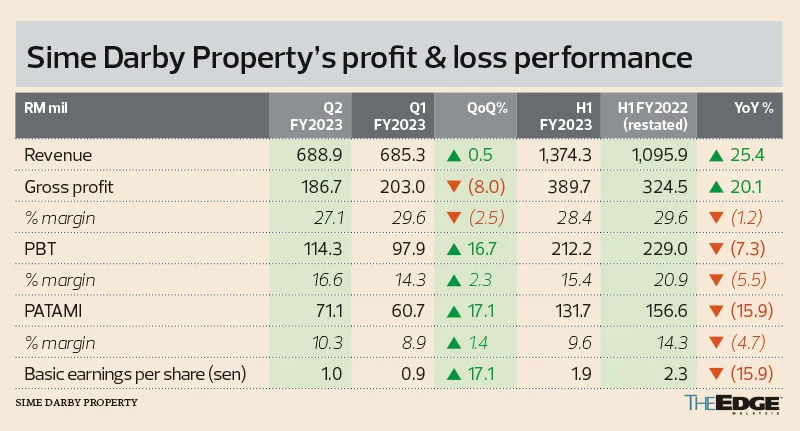

In the first half of the financial year ending Dec 31, 2023 (1HFY2023), SDP’s net profit fell 15.9% to RM131.7 million despite a strong 25.3% increase in revenue to RM1.37 billion.

The lower earnings were mainly a result of losses from its joint ventures — primarily the Battersea project — which had widened to RM46.7 million from RM7.1 million a year earlier. SDP and S P Setia each hold a 40% stake in the project while the EPF holds 20%.

Battersea suffered from higher interest charges following aggressive interest rate hikes in the UK — there were 14 straight hikes from December 2021 before the central bank paused last month — and softening demand for property.

Will things get worse? Azmir reckons that while challenges at Battersea will persist, the impact on SDP in the second half of the year will not be as big as in the first.

“We won’t remain in this situation for too long. Hopefully, we will see interest rates going down again. When interest rates normalise, I believe the market will come back. If you look at Battersea’s offerings, they are first class. Those who don’t have to buy, are not desperate to buy … the timing of their entry is very important to lock in a good interest rate.

“For us, we have some large units we want to sell, so what we have to consider is: do we take a bit of a hit [by offering discounts] and generate some cash flow, or do we stomach it and continue and hopefully we can sell next year? That is the question we are looking at,” he says.

As at June 30, Battersea had seen healthy take-up rates of 96% and 97% for completed residential apartments in Phases 2 and 3A respectively. Meanwhile, the commercial spaces in those two phases are 92% and 85% leased, respectively, and include major brands such as Apple, Uniqlo and Lego.

The latest launch, KOA residential apartments in Phase 3B, are about 50% sold. “These apartments, launched last year, are priced at £1,560 per sq ft. We are looking at the next phase, which is Phase 3C … it’s residential as well as commercial,” Azmir says.

At home, SDP’s biggest challenge is managing rising business costs. The cost pressures were reflected in the lower gross profit margin of 28.4% seen in 1HFY2023 compared with 29.6% a year earlier.

“The cost of business has gone up quite significantly. The price of raw materials has gone up, interest rates have gone up. It affects buyer sentiment and we have to also reprice some of our products. So, we will see margins coming off. What we’re trying to do is change our product mix.

“For example, we’ve been doing a lot of industrial products and these products have helped us maintain our margins. [They] give a higher margin than landed homes,” he explains.

SDP raised its property sales target for this year to RM2.7 billion from RM2.3 billion previously after achieving strong sales of RM1.5 billion in the first half, driven mainly by the industrial segment. Its unbilled sales as at June 30 stood at RM3.8 billion, providing decent earnings visibility for the group.

“This [higher sales target] is still conservative, in our opinion, considering current bookings worth RM1.9 billion to be (partially) converted to contractual sales in the second half,” says RHB Research in an Aug 29 report.

Bloomberg data shows that of 13 research houses that track the stock, 11 have a “buy” call on it while two have a “hold”, with the average 12-month target price at 78 sen. The stock has gained 39.4% since July to close at 64 sen on Oct 6, giving the company a market value of RM4.35 billion.

“We like SDP for: (i) its diversified portfolio in both landed residential and industrial products, which limits dependency on residential high-rise products, unlike certain peers that are in a state of oversupply, (ii) strong foothold in mature townships, (iii) proactive initiatives to boost recurring income via strategic investments, and (iv) its solar initiatives. However, we are concerned over the persistent losses from Battersea,” says Kenanga Research in an Aug 29 report. It maintains its “market perform” call on the stock but raised its target price by 20% to 66 sen.

‘I see resilience in our townships’

Last year, despite a host of challenges, Sime Darby Property Bhd (SDP) managed to rise to the occasion, turning in an operating profit of RM487.8 million — the highest ever since its demerger in 2017 from the conglomerate that it was once a part of.

Much of the challenges remain this year, with interest rates expected to stay higher for longer around the world as inflation remains elevated, even as cost of business rises and global economic growth slows.

Nevertheless, the chief of the country’s largest property developer by land bank is optimistic that sales will remain resilient amid the more challenging outlook.

“I see a resilience in our market segments, in our townships. We primarily cater for double-income households,” group managing director Datuk Azmir Merican tells The Edge in an interview.

“Our Serasi Residences in Putra Heights is in the RM250,000 to RM528,000 range. The first phase of 507 homes did very well. We sold 90% within that launch weekend. We have also launched products that are RM600,000, RM700,000, RM800,000. Our take-up rates are still pretty strong, 60%, 70% … even 90%. For industrial products, its 100%,” he elaborates.

Be that as it may, the group’s biggest challenge now will be to manage rising cost pressures as this could crimp earnings further. “The cost of doing business has increased. The cost of generating the interest in the market is also a lot more. Time to market has also taken longer,” he remarks.

Azmir, who joined the group in April 2020, speaks to The Edge at the SDP-owned Kuala Lumpur Golf & Country Club (KLGCC) in Bukit Kiara on a wide range of topics, from its Battersea Power Station development in the UK to Budget 2024. (SDP and S P Setia Bhd each holds a 40% stake in the Battersea project, while the Employees Provident Fund holds the remaining 20%.)

Below are excerpts from the interview.

The Edge: What do you see as the current sweet spots and price points in this kind of environment?

Datuk Azmir Merican: The market is resilient. The products that we launched — the lower end, the mid end, and the industrial products — did well. These are factors that augur well for us. We can see there is demand, real demand. At the same time, we see that the cost of doing business is increasing. No doubt, forex has an impact. So, we are cautious about the long term.

How is the Battersea Power Station project going? It dragged down your earnings in 1Q and 2Q. Will it get worse before it gets better?

You have to bear in mind, the UK is going through a time where the economy is quite affected. There has been [aggressive] interest rate hikes, so you can imagine, their economy and our economy are in different places. Property buyers, of course, would be a bit careful [in a high interest-rate environment]. Battersea is a premium location, and properties are not cheap. If you are going to buy a property, you would want to get the price right.

So, we are impacted. There is a general slowdown. Cost of doing business has also increased. Those are the factors against us at the moment. But if you ask me, can these be overcome? Yes, definitely. We won’t remain in this situation for too long. Hopefully, we will see interest rates going down again. When interest rates normalise, I believe the market will come back.

Are there any regrets about having gone into Battersea?

It was 10 years ago. If you look at the place, it’s very vibrant and happening. We’re proud of what we’ve done. Everybody [else] tried and failed. We, the three Malaysian companies, made it happen. It’s a difficult project, and we still have 10 to 15 years to go. So, it’s too soon to say. Like any project, there’ll be challenges, and you need to have a bit more endurance. We’ve learnt so much, it would be a shame not to capitalise on our knowledge today.

Do you still see value in holding on to Battersea?

We definitely see value.

You’ll still want to invest money in the upcoming phases and develop them?

Well, we are a 40% shareholder, we don’t really have to invest any more money. It’s able to sustain without us putting any money, so it should be able to generate enough money. If there is money [that is] going to be injected, I don’t think it will be too significant.

We know the government is trying to roll back subsidies. There could be a reintroduction of the Goods and Services Tax (GST) and, in the not so distant future, progressive wages. Will all these things help or be detrimental to your business?

It depends what the government does. I think they’re on the right track. They’re thinking about all kinds of possibilities and, at the same time, I think they’ve going to be very mindful of what they do because of the impact on the people, businesses and the country as a whole. So, whatever the government is thinking of to be progressive, it is positive for us.

But, what I think should happen is that the government should be very clear of what they want to do, and give us a bit of time to adjust. The market likes clarity. It likes to know this is the direction of the government, and it gives us time to absorb.

Do you think the government has been clear so far?

We have to wait for the details … it’s all in the implementation. We’re all working together. Engagements would be good.

What’s your dividend policy? Are there plans to improve on dividends?

We don’t have a policy. It’s usually about 20% to 50% of profit, but it’s more of a guidance. Yes, if we make more money, we will definitely pay more. We want to give out attractive dividends but we have to do it in a responsible way because we’re also investing in the future, we have the [industrial development fund], capital expenditure. At the same time, we have to preserve cash flow for our operations.

How much capex are you planning on for next year?

It’s still being worked on.

About the plane crash near Subang airport around your township, has there been any kind of impact on Sime Darby? A fall in property value or sales around that area?

No, no impact in property value or sales. It was a tragic event.

Are you happy about the plan to develop Subang Airport into something bigger?

We’re looking at that. Generally speaking, it should be good for everybody to have a development like that in a township, so that’s one thing. But we’ll have a look at it and see if there are any concerns.

What are you expecting from Budget 2024?

Whichever way it goes, I think we are an agile organisation, that we can capitalise on whatever affects us. I think what everybody wants to see is more clarity. We also want to see the details. For example, we are involved in the National Energy Transition Roadmap. That’s a very good plan and as it gets more and more clarity, I think it will help everybody plan, invest money, because they know this is what the government is prioritising, so we can put money in where we think it will generate the best returns. So, those kinds of things we’re very excited about.

What are the incentives that you’re looking at?

We had a couple before, like HOC (home ownership campaigns) and so on. It would be good to do HOC.

Is KLGCC profitable?

Last year, it broke even.

Do you reckon it can sustain profitability this year?

We’re spending a bit more money on it. We need to spend money to refresh the club, otherwise, the asset will look tired. It’s not a big impact on our P&L (profit and loss). It’s a very small part of our operations.

Azmir: Globally, property companies’ direction is to go smaller, not bigger

Following the proposed acquisition of UMW Holdings Bhd by Sime Darby Bhd, speculation is rife that Permodalan Nasional Bhd (PNB) will undertake another consolidation exercise and the target is likely to be one of the property development companies in which it has shareholding.

Saying that he is not in a position to comment as such decisions are made at the parent company level, Sime Darby Property Bhd (SDP) group managing director Datuk Azmir Merican opines that it is not necessary for a property development company to expand in terms of size. “If you ask me, the direction [being taken by] property companies around the world is to get smaller, not bigger. The bigger it is, the more complex it is to manage,” he says in an exclusive interview with The Edge at the Kuala Lumpur Golf and Country Club on Oct 2.

Ironically, Azmir helms Malaysia’s largest property development company. As at June 30, SDP had 15,434 acres of land bank with a total gross development value (GDV) of about RM119 billion.

That land bank is more than double the 6,870 acres owned by S P Setia Bhd, another PNB-controlled property developer. As for other developers, IOI Properties Group Bhd has 5,195 acres and UEM Sunrise Bhd has 8,532.5 acres.

PNB and its fund Amanah Saham Bumiputra (ASB) own 50.45% of SDP and 50.73% of S P Setia. Both companies are listed as PNB’s strategic investments. PNB and ASB are also major shareholders of IJM Corp Bhd, which has a substantial presence in property development. IJM is listed as a core investment of PNB, with a total shareholding of 19.78% as at June 30.

If PNB consolidated its holdings in the property development companies, the result would be a mega property developer with a land bank of more than 22,000 acres, or almost double the size of Putrajaya. But like Azmir says, it does not necessarily mean it will be a better group or a well-run outfit.

S P Setia is an example of how consolidations of property assets do not necessarily result in better returns for its shareholders.

The group was a result of the consolidation of PNB’s property assets carried out between 2009 and 2017. PNB acquired Pelangi Bhd from tycoon Tan Sri Robert Kuok Hock Nien for RM283.74 million in 2005. It then merged Pelangi with Petaling Garden Sdn Bhd and Island & Peninsular Sdn Bhd in 2009, resulting in the establishment of I&P Group Sdn Bhd.

Then in September 2011, PNB extended a conditional takeover offer of RM3.90 per share for the rest of the shares in S P Setia that it did not own. However, the offer was snubbed by S P Setia’s board of directors, who claimed that the price undervalued the group.

In January 2012, PNB and S P Setia major shareholder Tan Sri Liew Kee Sin launched an offer of RM3.95 per share for all the shares in the group they did not collectively own. This led to PNB controlling S P Setia. Subsequently, Liew exited the group and went on to helm Eco World Development Group Bhd.

In June 2017, S P Setia signed a conditional share purchase agreement with PNB and AmanahRaya Trustees Bhd to acquire I&P Group Sdn Bhd for RM3.6 billion. The consolidation injected more than 4,000 acres of land bank belonging to I&P into S P Setia. As a result, S P Setia’s land bank grew to 9,417 acres.

In the financial year ended Dec 31, 2017 (FY2017), S P Setia made a net profit of RM933 million — its highest ever. However, in the following financial year, its net profit fell to RM671 million.

S P Setia has never recaptured the level of profitability seen in FY2017, although this can be attributed to the challenging property market. In FY2022, S P Setia made a net profit of RM308 million. Its net gearing ratio of 0.57 times was higher than the 0.1 times in FY2017.

Although PNB acquired the remaining shares in S P Setia at RM3.95 apiece, the share price hardly breaches RM1 nowadays. The property market challenges faced by Battersea Power Station in the UK is also dragging down S P Setia and SDP.

Meanwhile, PNB’s property development firms have been disposing of their land banks recently. Wholly-owned Seriemas Development Sdn Bhd is selling two freehold parcels measuring a total of 435.23ha in Kulai, Johor, to Lagenda Properties Bhd’s 70%-owned subsidiary Lagenda Mersing Sdn Bhd for RM398.21 million cash.

In July, Scientex Bhd’s indirect subsidiary Scientex Lestari Sdn Bhd inked a conditional sale and purchase agreement with Seriemas for the purchase of 550.67 acres in Kulai for RM299.84 million.

Scientex Lestari is also acquiring eight freehold parcels measuring a total of 959.72 acres in Tebrau, Johor, from S P Setia’s indirect subsidiary Pelangi for RM547.65 million.

So, could there be another round of consolidation for property developers led by PNB in the near future?