THE EDGE. 26TH OCTOBER: There has been a pick-up in overall transaction activity in the Klang Valley residential property market, indicating better confidence among buyers, according to Savills Malaysia director of research and consultancy Fong Kean Hwa in presenting the The Edge | Savills Klang Valley Residential Property Monitor for 2Q2023.

Based on National Property Information Centre (Napic) data, he notes that 10,654 high-rise residential units worth RM6.12 billion were transacted in the Klang Valley in 1H2023, and that both Kuala Lumpur and Selangor are on track to match the transaction activity last year (2022: 22,673 units).

“The total transaction volume and value for high-rise residential property were seen coming on track in 1H2023. Buyers were seen prudently gravitating towards value-for-money deals on properties with unique propositions that are likely to attract better returns in the future.”

In Kuala Lumpur alone, 4,494 high-rise units worth RM3.52 billion were transacted.

“Although transaction volume remained healthy, the average transaction price dropped by 8.2% in 1H2023 to RM783,589 from RM853,150 in 2022. This predominantly indicates the well-calculated approach buyers seem to be taking, especially in expensive markets,” he explains.

In Selangor, 6,160 high-rise units worth RM2.6 billion were transacted in 1H2023, whereby the average transaction price improved by 6.7% to RM422,937 from RM396,499 in 2022.

Similar to high-rise properties, transaction activity for landed houses in the Klang Valley was picking up, Fong observes.

In Kuala Lumpur, 1,503 landed units worth RM1.96 billion were transacted in 1H2023. The average transaction price dropped slightly by 3.6% to RM1.3 million. Out of the 1,503 units, almost three quarters of the transactions were for terraced houses, says Fong.

“The average transaction price for 1-storey units (terraced and semi-detached houses) improved, along [with that of] detached houses. Meanwhile, average transacted prices for the multi-storey units (terraced houses and semidees) and cluster houses tumbled compared to 2022.”

In Selangor, a total of 14,513 landed units worth RM10.27 billion were transacted in 1H2023. In contrast to Kuala Lumpur’s performance, the average transaction prices in Selangor remained broadly stable with a slight improvement of 1.4% to RM708,246, Fong notes.

“The average transaction price was seen improving across all property types except detached and cluster houses.”

In terms of supply, Fong observes that the high-rise residential market witnessed a moderate supply in 1H2023 as there were limited units completed.

He notes that 17,946 new units were added to the existing supply in the overall Klang Valley market (Kuala Lumpur: 10,507 units; Selangor: 7,439 units) in 1H2023.

“At this rate, Klang Valley is expected to see an addition of 35,000 to 40,000 new units in 2023, far less compared to 2022 (61,587 units) but almost on a par with the supply during the pandemic (2021: 39,508 units; 2020: 45,046 units).

“The drop in expected completions shows cautious sentiment among developers amid heightened challenges. This could be attributed to limited launches from 2019 onwards as the market began to shrink,” Fong adds.

As for landed supply, Fong observes that a pick-up in construction activity resulted in substantial new supply entering the market, particularly in Selangor. He notes that the cumulative existing stock of landed residential properties in the Klang Valley stood at 958,078 units as of 1H2023.

In 1H2023, 14,998 units were completed in Selangor suburban areas, surpassing the supply in 2022 (14,814 units), he notes. “With the new additions, the total supply of landed residential units in Selangor is 858,117 units. The newly completed supply spans across all categories such as terraced, semidee, detached and cluster houses.”

According to him, the total stock of landed units in Selangor has been increasing from 1.7% to 2.5% year on year (y-o-y) for the past three years (2020 to 2022).

However, landed residential activity in Kuala Lumpur has remained muted with no new completions. The total supply in Kuala Lumpur stood at 99,961 units as of 1H2023.

“Between 2020 and 2022, only 357 landed units were completed in Kuala Lumpur, indicating the limited demand and construction activity. This is likely due to the higher land cost and elevated prices for the landed units, limiting prospective purchasers to HNWIs (high-net-worth individuals),” he says.

Meanwhile, Fong notes that some developers were seen to be moving away from the challenging high-end market and focusing on mid-range or affordable projects. This, he says, has resulted in limiting the future supply that will enter the market.

With an overall neutral outlook on the Klang Valley housing market, Fong expects to see developers remain highly vigilant about new launches. “Although launch activity has improved slightly compared to the pandemic years, limited transaction activity is forcing developers to focus on certain geographical pockets and types of properties that remain in demand.”

Additionally, developers are expected to come up with upgraded offerings to meet modern lifestyles beyond cash rebates and discounts on legal and memorandum of transfer fees, he says.

“Smart gadgets, electric vehicle charging stations and convenient access to modern services are likely to be an integral part of new launches. Environmental, social and corporate governance will become part of the sales and living experience.”

Terraced houses with attractive prices, he adds, are likely to remain the popular choice among developers and buyers. “Projects with easy accessibility from key highways and mature neighbourhoods are likely to remain the primary choice.”

He adds that upcoming infrastructure projects will likely act as catalysts to boost the market.

Nonetheless, challenges remain. “Although headline inflation seems to be moderating compared to the recent past, it remains high. This is expected to weigh down on disposable income levels and, subsequently, on consumer sentiment. The overnight policy rate increase by 25 basis points to 3.0% in May has resulted in more expensive home loans, which adds to the challenges prospective homebuyers face and ultimately hampers demand.

“Additionally, hikes in land prices, building materials, operating costs and labour costs are bound to push property prices upwards. With pressure on both fronts, the property market is likely to remain challenging amid a cautious stance among investors,” says Fong.

High-rise

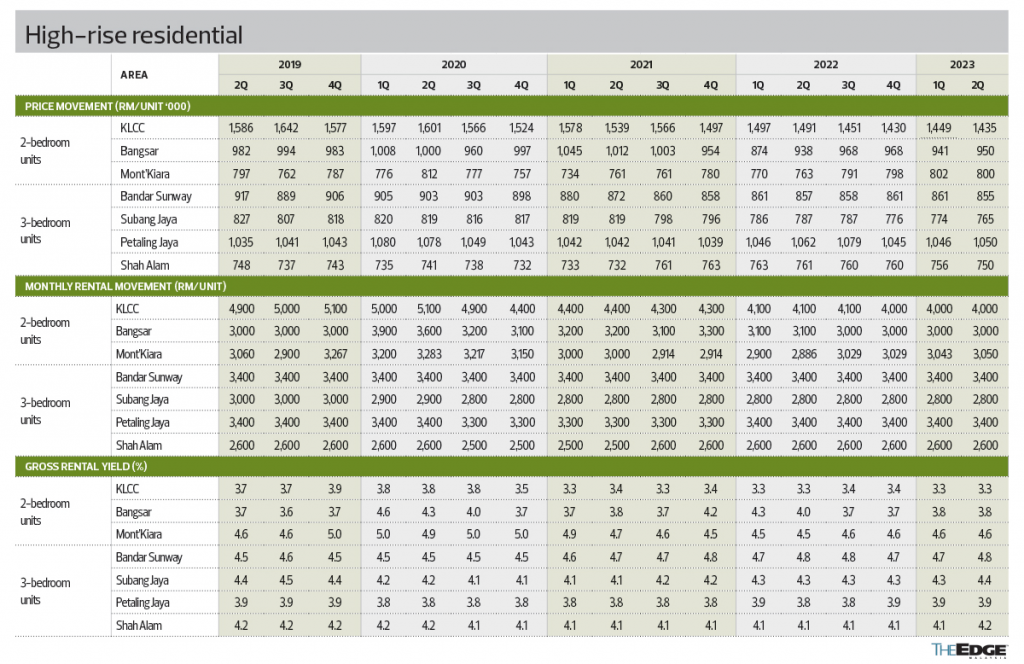

During the quarter under review, the investor-dependent market of KL city centre (KLCC) remained under pressure, whereas Bangsar and Mont’Kiara remained stable quarter on quarter, says Fong.

Y-o-y, the average price in KLCC dropped by 4%, while Bangsar and Mont’Kiara prices jumped 1% and 5% respectively.

In terms of rent, KLCC continued to see a drop of 2% y-o-y, whereas Bangsar held steady and Mont’Kiara continued to improve by 6%.

“New residential properties in KLCC primarily cater to local and foreign investors. The units are smaller to make them cost-effective and easily rentable to short-term tenants. This market is struggling to perform as an outcome of the pandemic and stringent MM2H (Malaysia My Second Home) regulations. As a result, some developers seem to prefer launching units with attractive pricing which appeals to a larger consumer base,” says Fong.

During the quarter, Exsim Group soft-launched its second project in KLCC, namely Kyliez Suites, following Hugoz Suites (launched in 4Q2022). The former comprises 346 dual key small office/home office (SoHo) units measuring 323 to 657 sq ft with selling prices ranging from RM700,000 to RM1.33 million.

Bangsar and Mont’Kiara, on the other hand, remained popular choices among high-income homebuyers and tenants, Fong observes. “Although Bangsar did not witness any high-end project launches, three projects were launched in Mont’Kiara between January and June this year.”

During the review quarter, The Minh by UEM Sunrise Bhd and Bon Kiara by Bon Estates Sdn Bhd were launched.

The Minh offers 496 units ranging from 1,607 to 3,010 sq ft with three- to five-bedroom layouts. Selling prices at The Minh range from RM1.4 million to RM2.8 million, or an average of RM960 psf.

Bon Kiara comprises 410 units ranging from 2,018 to 3,075 sq ft with three- to five-bedroom layouts. The average selling price of this project is RM650 psf due to its location in Jalan Kiara 3.

Over in Selangor, average prices saw a slight adjustment y-o-y in all submarkets except in Bandar Sunway, while rents remained stable.

“This resulted in improved rental yields,” Fong notes.

In Bandar Sunway, average prices and rents remained stable y-o-y, resulting in a steady yield from 4.3% to 4.4%.

Petaling Jaya’s average price dropped marginally by 1% while the average rent remained unchanged y-o-y, resulting in a slightly higher yield of 3.9% from 3.8%.

Similarly, Shah Alam’s average price dropped slightly by 1% while the average rent remained unchanged y-o-y, resulting in a slightly higher yield of 4.2% from 4.1%.

Double-storey

terraced houses

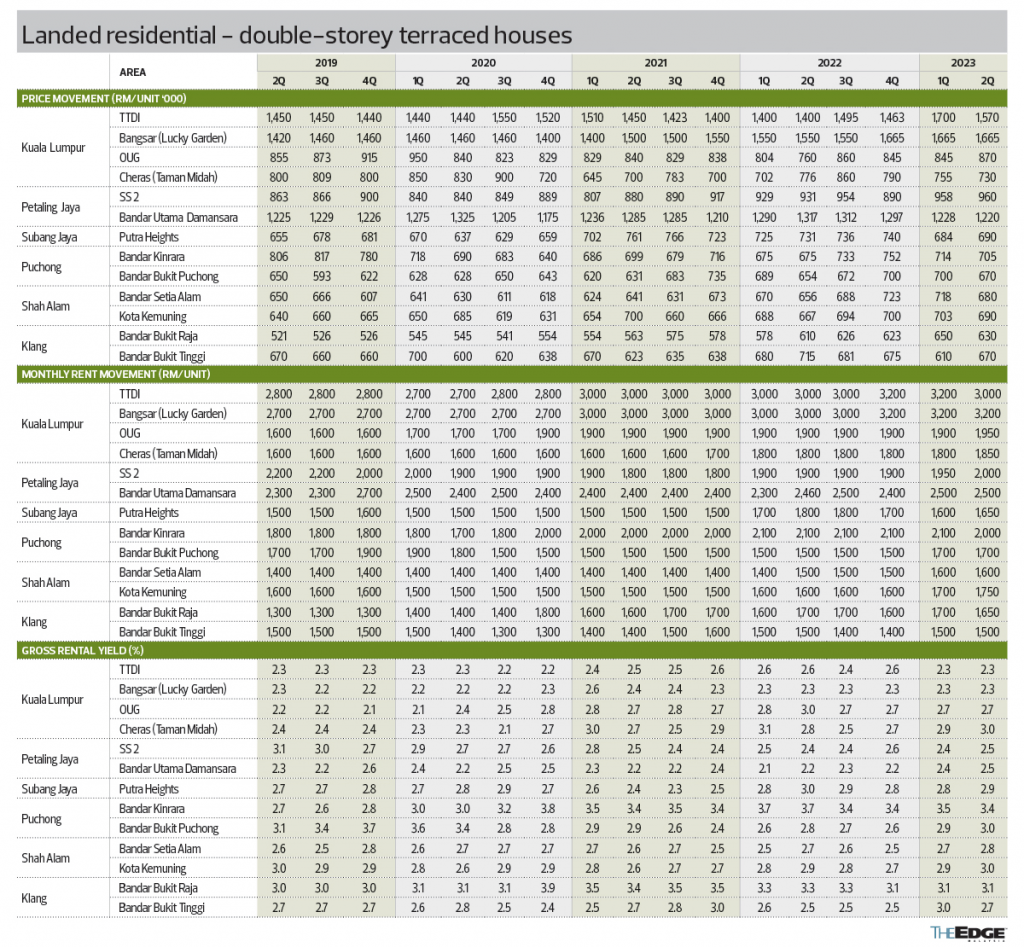

During the quarter under review, 2-storey terraced houses in Kuala Lumpur saw encouraging performance, with three out of four submarkets showing positive performance in terms of price as well as rent, says Fong.

The 2-storey terraced houses in Taman Tun Dr Ismail saw a surge in average price by 12% to RM1.57 million y-o-y. In contrast, rental yields contracted from 2.6% to 2.3% as average monthly rentals remained steady.

Bangsar’s Lucky Garden saw its average price and rent increase by 7% y-o-y during the review period. This resulted in steady rental yields of 2.3% over the last year.

OUG witnessed a similar performance, whereby the average price and rent improved by 14% and 3% respectively. Due to a higher improvement in average prices, rental yields dropped from 3.0% to 2.7%.

Taman Midah in Cheras saw its average price drop by 6% y-o-y, while its average monthly rent jumped by 3%, resulting in higher rental yields of 3.0%, the highest in the selected Kuala Lumpur submarkets.

Over in Selangor, 2-storey terraced houses showed encouraging performance, with six out of nine submarkets registering positive performance in terms of price as well as rent, says Fong.

SS2 in Petaling Jaya saw positive performance in both price and rent. The average price increased y-o-y by 3% and the average monthly rent improved by 5% during the same period. Due to this, rental yields increased from 2.4% to 2.5%.

In contrast, Petaling Jaya’s Bandar Utama saw its average price decline by 7%. However, the average monthly rent increased marginally by 2%. As a result, rental yields increased from 2.2% to 2.5%.

The performance of Subang Jaya’s Putra Heights was the most concerning this quarter, says Fong, as the average price there dropped significantly by 6% y-o-y. Additionally, average monthly rentals also dropped substantially by 8%. “Although the rental yields remained broadly stable at 2.9% in 2Q2023, overall performance was not encouraging.”

In Bandar Kinrara, Puchong, the average price increased by 4% y-o-y while the average monthly rent dropped 5% y-o-y. As a result of improving prices and contracting rents, yields declined from 3.7% to 3.4%.

Bandar Bukit Puchong witnessed the highest y-o-y performance in terms of rent.

“As average prices improved marginally by 2% y-o-y, the average monthly rent improved by a staggering 13% y-o-y in the last four quarters,” Fong notes.

At Shah Alam’s Bandar Setia Alam, both price and rent increased marginally y-o-y. The average price increased by 4% while the average monthly rent increased by 7%. Stronger rent as compared to price resulted in a higher rental yield from 2.7% to 2.8%.

Similarly, terraced houses in Kota Kemuning improved in terms of price as well as rent. The average price increased by 3% y-o-y while the average monthly rent witnessed an uptick of a substantial 9%. As a result, rental yields increased from 2.9% to 3.0%.

In Klang’s Bandar Bukit Raja, the average price improved by 3% y-o-y and the average monthly rent dropped by 3%. Rental yields slipped from 3.3% to 3.1%.

“Also in Klang, Bandar Bukit Tinggi’s property performance was comparatively disappointing,” Fong says.

The average asking price dropped by 6% y-o-y while the average monthly rent remained constant. As a result, the rental yield improved from 2.5% to 2.7%.

Two-storey semidees

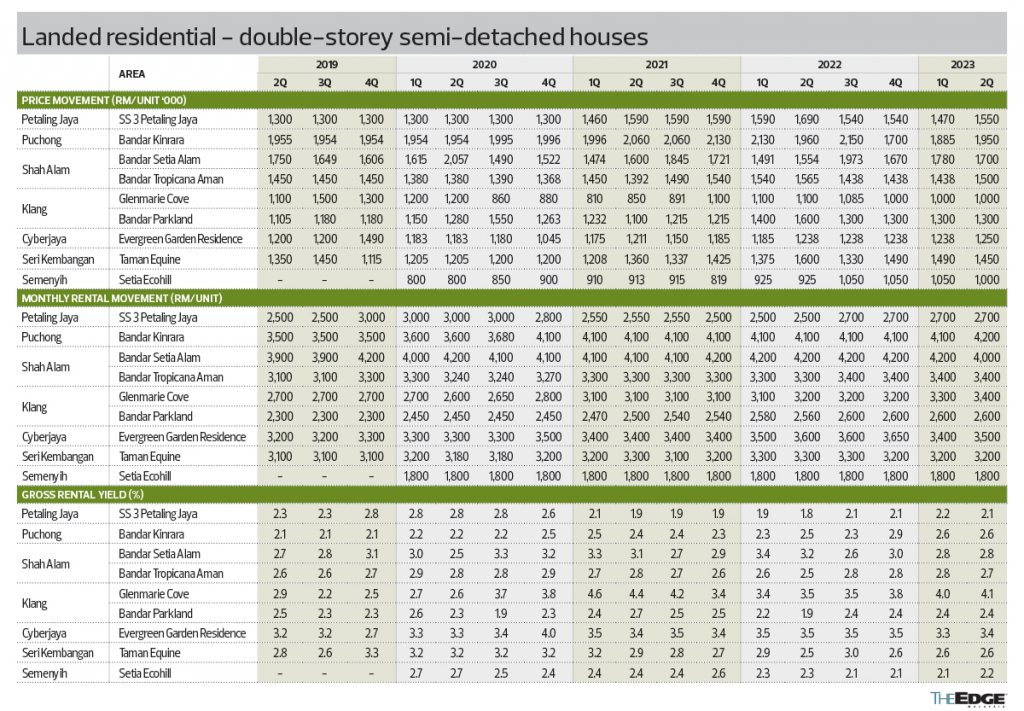

During the review quarter, all monitored areas for 2-storey semidees saw a relatively stable rental market, whereas prices remained under pressure, notes Fong.

In Petaling Jaya’s SS3, a substantial y-o-y drop of 8% in average price was recorded, but the average monthly rent moved northwards by 8%. As a result, the rental yields improved from 1.8% to 2.1%.

The average transaction price in Puchong’s Bandar Kinrara was stable but the average rent saw a slight improvement. The rental yields jumped slightly by 0.1% to 2.6%.

Moving to Bandar Setia Alam in Shah Alam, the average price remained on an upward trajectory by 9% y-o-y, while the average monthly rent declined by 5%, resulting in a drop in rental yields from 3.2% to 2.8%.

Also in Shah Alam, Bandar Tropicana Aman witnessed an opposite trend whereby the average price dropped by 4% y-o-y, whereas the rental yields improved from 2.5% to 2.7% as the average monthly rent improved by 3%.

In both Glenmarie Cove and Bandar Parkland in Klang, the average prices plunged significantly y-o-y, whereas the average rents either improved or were maintained, notes Fong. “For that reason, this region has shown the most promising improvement in rental yields.”

In Glenmarie Cove, the average price dropped by 9% y-o-y whereas the average monthly rent increased by 6%. The rental yields moved up from 3.5% to 4.1%.

As for Bandar Parkland, the average price declined by 19% y-o-y. However, the average monthly rent recorded a marginal improvement of 1.6%. As a result, rental yields improved from 1.9% to 2.4%.

At Cyberjaya’s Evergreen Garden Residence, the average price remained relatively stable with a 1% improvement and a 3% drop in the average rent. Rental yields dropped from 3.5% to 3.4%.

In Taman Equine in Seri Kembangan, both the average price and rent dropped on a y-o-y basis, by 9% and 3% respectively. This led to an increase in rental yields from 2.5% to 2.6%.

In Setia Ecohill in Semenyih, while average prices improved by 8% y-o-y, the average rent remained stable, resulting in a drop in rental yields from 2.3% to 2.2%.

“Comparing an overall average y-o-y performance, the rental yields of semidees have improved, and those of high-rise properties and landed terraced houses have remained stable,” says Fong.

He adds that the reopening of international borders, influx of expatriates and improving economy have helped in holding property returns. “Further, economic growth in the future and favourable government policies coupled with political stability will continue to stabilise the residential market.”