NEW STRAITS TIMES. 31ST OCTOBER: There may be a shortage of homes in the mass-market price range of RM500,000 in Malaysia next year.

This is because homes priced at RM500,000 (high-rise) accounted for a decreasing share of new construction in the country.

These more affordable homes accounted for 71.1 per cent of all newly launched residential properties in 2022.

However, their share dropped by more than 13 percentage points in the first half to just 58 per cent, according to Juwai IQI co-founder and group chief executive officer Kashif Ansari.

Having said that, Kashif highlighted one positive trend in the housing market, which is a decrease in Malaysia’s unsold housing unit overhang.

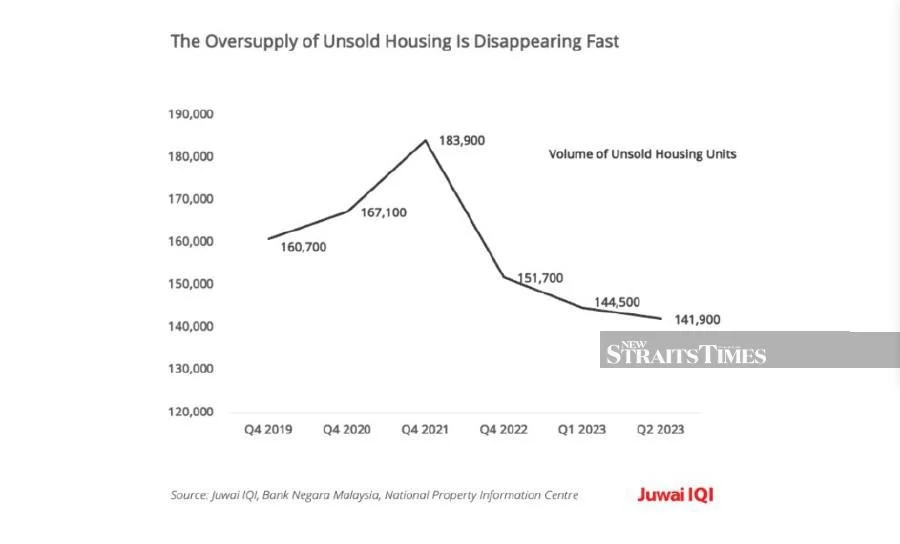

Overhang began to shrink in 2022 and has continued to shrink throughout the first half of the year.

In 2021, the number of unsold homes peaked at 183,900 but had fallen to 141,900 by the second quarter of this year, and the trend is still downward.

According to Kashif, the supply of unsold expensive high rises has improved the most.

“The volume of unsold housing is now 12 per cent lower than in 2019 and 23 per cent below its 2021 peak. That’s a big relief for the housing industry. It helps stabilise pricing and makes price trends more predictable,” he said.

Kashif said that affordable housing is selling faster than higher-priced homes, despite the fact that the oversupply of units has improved the most among relatively expensive high-rise homes.

Houses priced at RM500,000 or less accounted for nearly 80 per cent of all purchases in the first half of the year.

Home prices are also rising at a more sustainable rate than before Covid.

Prices rose 4.8 per cent in the first quarter of 2023, up from 3.9 per cent the previous quarter.

Kashif said that while this is a faster rate, it is still lower than the 5.3 percent long-term average from 2015 to 2019.

“We see three factors driving this demand. Homebuyers have more money and are more likely to have good jobs. Also, buyers want to take advantage of the stamp duty exemptions provided by the Malaysian Home Ownership Initiative.

“Household finances are strong, household debt is manageable, and private sector wages are up by 4.1 per cent, which boosts household income. Employment is also up, which also contributes to household income and the confidence to buy a home. The number of people with jobs increased by more than 208,000 in the second quarter alone,” he said.

Kashif believes that Bank Negara’s decision to keep the Overnight Policy Rate unchanged this month will help Malaysia maintain its current economic growth and allow more people to afford to buy a home.

He also thinks that if the US Federal Reserve maintains its “higher for longer” interest rate regime in 2024, Bank Negara will face increased pressure to raise rates and stop the Ringgit from falling further.