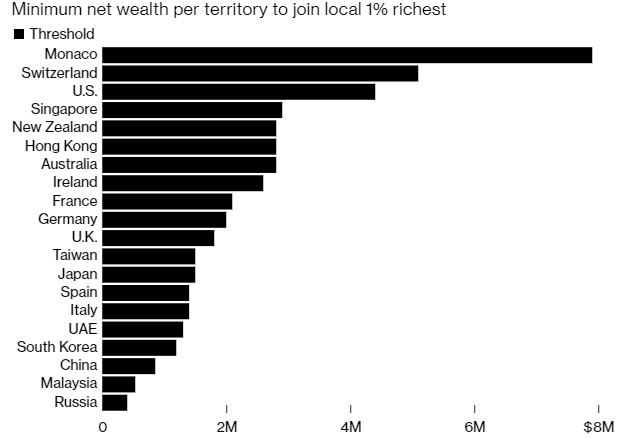

It takes a networth of RM32 million in Monaco to be in the top 1% locally, but about half that amount in the U.S. and Switzerland. Singapore too has a high threshold, a new report shows.

Source: Bloomberg Wealth

The U.S. leads in the number of ultra-rich individuals even as wealth growth has surged recently in Asia-Pacific locations such as China and Hong Kong, according to the report. The region’s richest billionaires are now worth a combined $2.7 trillion, data compiled by Bloomberg show, or more than triple the amount at the end of 2016. Asia Pacific is forecast to continue outpacing global growth in ultra-high net-worth individuals from 2020 to 2025, with the number of people with more than $30 million climbing 33% led by India and Indonesia.

For Malaysia, an average of USD$540,000 in networth (Approximately RM2.16 million) will place you in the top 1% locally.

It is noteworthy that the report, which measures in USD dollars, placed Malaysia below China, which takes USD$850,000 to be in the top 1% locally in China. This is not surprising given the largest economy in the world, with new billionnaires marking their entry every month. Malaysia’s performance is due to the depreciation of the ringgit, which currently stood at USD1: RM4.04 (25th Feb 2021). It is crucial to note that while Malaysia’s exports of nitrate gloves are in the billions of ringgit, it is disheartening that Malaysia had not achieve a good performance in international rankings when it comes to its income levels. Its top 1% are below countries that were once on par with, such as Singapore, South Korea and Taiwan.

It is a matter of time Thailand and Vietnam would overtake Malaysia should Malaysia’s government continues its flawed focus of economic policies that focuses on racial cards instead of targeting the vulnerable groups regardless of race and religion. There are also a variety of crucial actions to be taken, such as combating corruption, increasing investor confidence and pulling in foreign investors.